In 2026, financial security and flexibility have become more important than ever. People everywhere are feeling the impact of rising prices and a changing job market.

Many are turning to creative ways to build a second income. This shift is driven by economic uncertainty, inflation, and new trends in how we work.

This article reveals seven practical and innovative strategies for creating a second income. You will discover both traditional and tech-powered methods to help you earn more and gain peace of mind.

Ready to explore fresh opportunities for extra earnings? Dive in to see which second income ideas could work for you.

Economic uncertainty and rising living costs are shaping how people think about their financial future. More than ever, individuals are searching for stability and flexibility—and building a second income is becoming the smart way to achieve both.

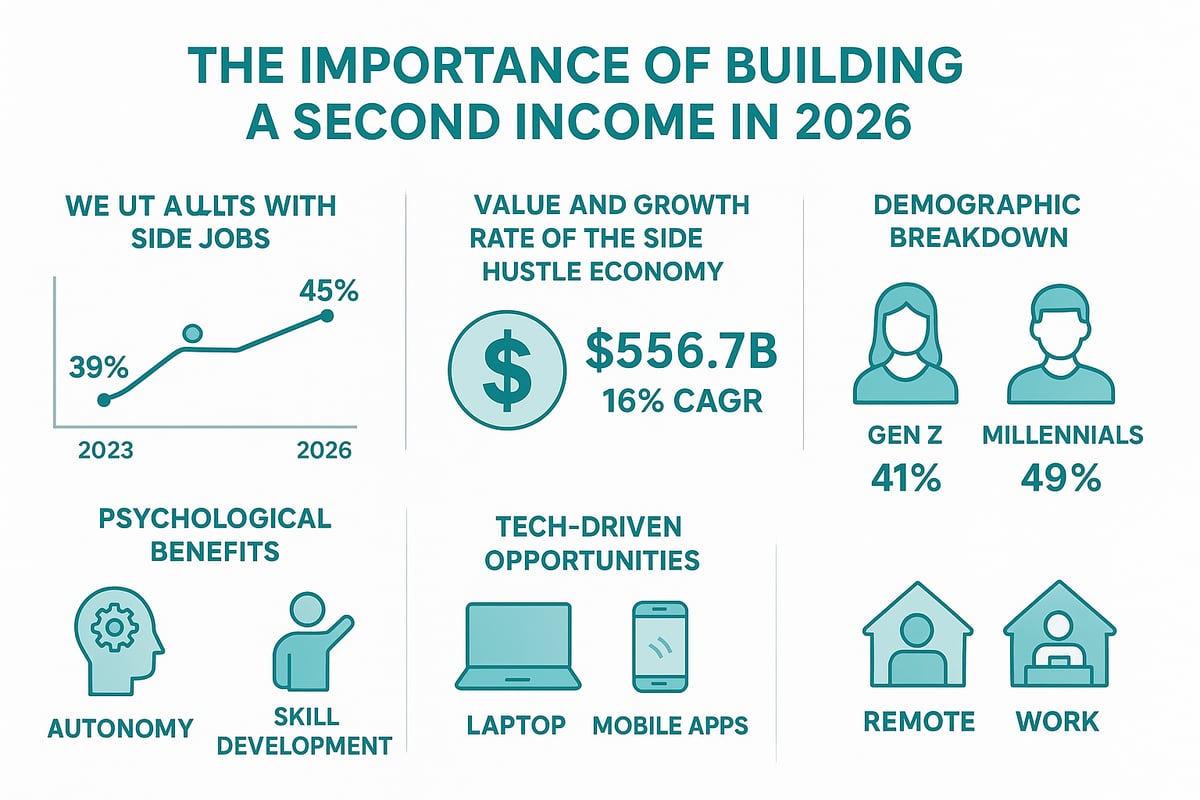

Recent data shows just how widespread this trend has become. Nearly 39% of adults in the U.S. held a second job in 2023. The side hustle economy reached a staggering $556.7 billion in 2024, with an impressive 16% annual growth rate. According to the Bankrate Side Hustle Survey 2024, side gigs are no longer a niche pursuit but a financial necessity for millions.

Why are so many people prioritizing a second income? The answer is resilience. A steady second income can be the safety net that covers surprise expenses, helps pay off debt faster, or even funds long-term goals like buying a home or investing. In a world where job security is uncertain and inflation eats into savings, an extra income stream is a buffer against the unexpected.

Let’s look at who is leading this movement. Demographic trends reveal that 45% of Gen Z and 36% of Millennials are actively working side jobs. This is more than just about money—it is about gaining independence, building new skills, and boosting confidence. Many report feeling more in control of their lives and futures because they are not solely dependent on one paycheck.

The psychological benefits are real. People who earn a second income often describe a sense of autonomy and empowerment. They learn to manage time, develop marketable skills, and even discover new passions. For example, a teacher may tutor online in the evenings, while a graphic designer might freelance on weekends, both turning talents into tangible financial rewards.

Technology has played a huge role in making second incomes more accessible. Remote work, digital platforms, and mobile apps have lowered the barriers for anyone wanting to start a side hustle. Whether it is launching an online course, renting out property, or offering freelance services, opportunities are more diverse and reachable than ever before.

Consider the variety of options available today:

| Opportunity Type | Examples | Main Benefits |

|---|---|---|

| Digital | Online courses, UGC | Flexible, scalable |

| Property | Fractional real estate, Airbnb | Passive income, diversification |

| Creative | Freelancing, coaching | Skills growth, autonomy |

The bottom line? Building a second income in 2026 is not just about extra cash—it is about securing your future, growing as a person, and taking charge of your financial destiny. With so many paths available, there has never been a better time to explore what a second income can do for you.

Looking to future-proof your finances? The quest for a second income is more relevant than ever in 2026. With technology exploding and work trends shifting, opportunities for earning extra money have never been more diverse or accessible.

Below, discover seven creative, actionable paths—blending traditional wisdom with cutting-edge tech—to unlock your earning potential and secure your financial future.

Fractional real estate investing opens doors for anyone wanting a second income without the burden of buying an entire property. This approach lets you invest small amounts—sometimes as little as $100 to $500—in high-value properties alongside others.

Platforms like Stake, Fundrise, and RealtyMogul make it easy to get started. In 2024, Stake reported average annual returns of 10.1%, attracting a wave of new investors searching for reliable second income streams.

Benefits of fractional real estate:

Compare this to other real estate options:

| Option | Entry Cost | Liquidity | Passive Income | Risk Level |

|---|---|---|---|---|

| Fractional RE | Low | Moderate | High | Moderate |

| REITs | Low | High | Moderate | Low |

| Direct Rentals | High | Low | High | High |

Many investors have built a second income by pooling resources with others. For example, Sarah, a teacher, invested $500 across multiple properties and now receives quarterly dividends—no property management needed.

Risks include market fluctuations, platform fees, and liquidity constraints. Always research platforms and read the fine print. If you want a steady, hands-off second income, fractional real estate might be your perfect entry point.

The e-learning boom is a goldmine for anyone with expertise to share. Selling online courses lets you turn your knowledge into a scalable second income, reaching students worldwide through platforms like Teachable and Udemy.

Popular course topics in 2026 include AI skills, business strategy, coding, personal development, and creative arts. These platforms handle hosting, payments, and even marketing, so you can focus on delivering value.

Why choose online courses for your second income?

Success stories abound. For example, Mike, a graphic designer, launched a Photoshop basics course and now earns $1,200 monthly in passive income.

Tips for beginners:

Quality and student engagement are key to sustainable second income. Regularly update your course and interact with learners to build trust and boost reviews.

Freelancing gives you the power to monetize your skills and create a flexible second income. In 2026, platforms like Upwork, Fiverr, and Toptal connect professionals with clients seeking everything from writing and design to programming and marketing.

In-demand freelance skills:

Getting started is straightforward. Build a standout profile, set competitive rates, and showcase your portfolio. Many freelancers start small, then scale their second income into full-time careers.

Freelance earnings snapshot:

| Skill | Avg. Hourly Rate | Demand (2026) |

|---|---|---|

| Writing/Editing | $30–$60 | High |

| Web Development | $50–$120 | Very High |

| Marketing | $40–$90 | High |

Real-world examples include Lisa, who supplements her teaching salary with freelance curriculum design, earning an extra $800 per month.

Pros? Flexibility, autonomy, and unlimited earning potential. Cons? Income can fluctuate and client acquisition takes effort. Still, freelancing remains one of the most adaptable routes to a second income in today’s digital world.

User-generated content (UGC) creators are in high demand. Brands pay for authentic photos, videos, and reviews—not just from influencers, but from everyday people. This is a fantastic way to build a second income with creativity and minimal followers.

How to get started:

Earnings vary, but a single UGC video can pay $100–$500. With a few projects monthly, you can develop a reliable second income.

Skills needed include basic photography, video editing, and understanding brand messaging. For example, Alex, a student, earns $600 monthly by creating short videos for skincare brands.

Challenges: The market is competitive, and creative demands are high. Stay updated on trends and always read platform policies.

UGC creation is perfect for those who love storytelling and want a flexible, creative second income that fits around any schedule.

AI has revolutionized the side hustle landscape, making it easier than ever to create a second income. In 2026, AI tools enable automated blogging, YouTube video creation, AI-driven e-commerce, and digital product development.

AI-powered side hustles stand out for their scalability and relatively low entry barriers. For instance, automated blogging platforms use AI to generate content, while e-commerce tools handle inventory and customer service.

Popular AI side hustles:

Platforms like Jasper, Synthesia, and ChatGPT help streamline these businesses. Case studies show individuals earning thousands monthly with minimal manual effort.

Advantages:

However, staying updated with AI trends, managing tool costs, and considering ethical implications are essential. To explore more AI-powered opportunities for a second income, check out this Best AI Side Hustles in 2026 guide.

Choose an AI side hustle that matches your interests and skills. The right approach can turn technology into a powerful ally for your second income journey.

Online tutoring and coaching remain reliable ways to earn a second income. Demand is high in academic subjects, professional skills, and personal development. Platforms like VIPKid, Wyzant, and Coach.me connect you with clients worldwide.

How to launch your tutoring or coaching side gig:

Tutors can earn $20–$80 per hour, while coaches often charge $50–$200 per session. For example, Priya, a software engineer, tutors coding online and brings in $1,000 monthly as a second income.

Requirements vary. Some platforms need certifications, while others focus on experience. Marketing is crucial—use social media, content marketing, and referrals to attract clients.

Scaling is possible by offering group sessions or creating online resources. Online tutoring and coaching offer a flexible, rewarding path to a second income that empowers others.

Short-term rentals remain a top way to secure a second income in 2026. With platforms like Airbnb, Vrbo, and even parking space apps, you can monetize spare rooms, entire homes, or unused spaces.

Benefits of property rentals:

Average Airbnb hosts in popular cities can earn $1,500–$3,000 per month. For example, David rents out his guest suite and covers his mortgage, turning his home into a steady second income source.

Tips for success:

Legal compliance and maintenance are key. Research your area’s rules before starting. With the right approach, property rental can be a reliable, scalable second income stream.

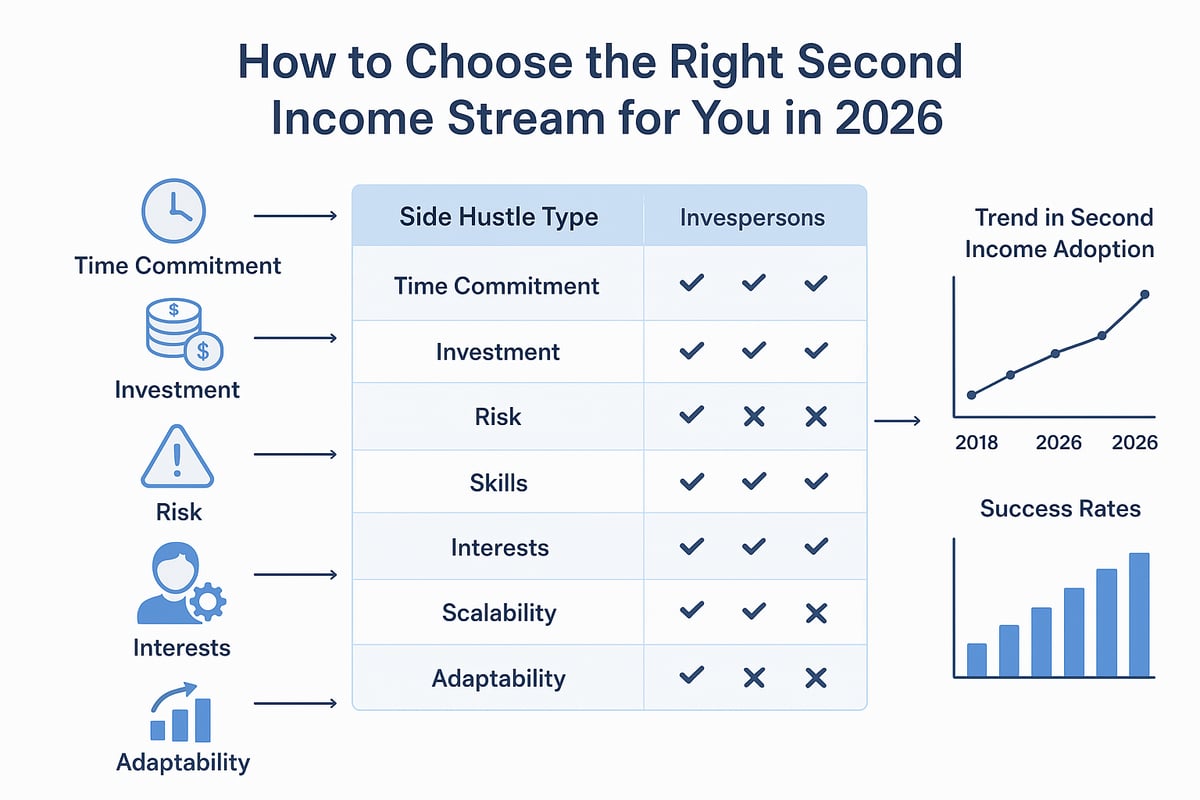

Finding the perfect second income stream is more than just picking a popular trend. It starts with understanding how each opportunity fits your unique situation. With so many options available in 2026, a strategic approach helps you avoid overwhelm and find a path that truly works for you.

Start by assessing the key factors that define a successful second income. Ask yourself:

A simple comparison table can help clarify your options:

| Criteria | Low Time | Low Investment | Low Risk | Skill-Based | High Scalability |

|---|---|---|---|---|---|

| UGC Creation | ✔️ | ✔️ | ✔️ | ✔️ | Moderate |

| Online Courses | Moderate | Moderate | Moderate | ✔️ | High |

| Fractional RE | ✔️ | Moderate | Moderate | Moderate | |

| AI Hustles | ✔️ | Low | Moderate | High |

Analyzing these criteria ensures your second income isn't just profitable but also sustainable for your lifestyle.

The best second income stream is one that aligns with your interests, strengths, and daily routine. Are you energized by creative projects, or do you prefer analytical tasks? Do you enjoy teaching, or would you rather invest quietly behind the scenes?

Matching your side hustle to your personality increases motivation and reduces burnout. For example, those who love sharing knowledge may thrive in online tutoring, while tech enthusiasts could explore AI-powered opportunities. Consider your current commitments and energy levels to ensure your second income complements, rather than conflicts with, your main job and personal life.

Before diving in fully, test your second income idea with a small pilot. Start with minimal investment and time, then track your progress. Use market research to identify gaps or upcoming trends. This low-risk approach lets you pivot quickly if an idea isn't working.

Look for side hustles that offer scalability. Can your efforts eventually generate passive income? For instance, building a blog or selling digital courses can compound over time. Tools and communities can help you refine your approach as you grow.

The landscape for earning a second income is evolving rapidly, especially with advances in technology and remote work. Stay open to learning new skills and adapting as trends change. Many successful earners have pivoted between side hustles before finding their best fit.

Leveraging resources like Building Multiple Income Streams with AI can help you future-proof your second income strategy by tapping into automation and tech-driven opportunities. Remember, continuous learning and adaptability are your greatest assets in building a resilient financial future.

Ready to take your financial future into your own hands? Building a second income is less intimidating when you break it into clear, manageable steps. Here is your action plan to get started confidently and see results faster.

Set Clear Goals

Decide exactly why you want a second income. Is it to pay off debt, save for a big purchase, or build long-term wealth? Defining your "why" keeps you motivated.

Assess Your Skills and Interests

List your strengths, passions, and any free time you can dedicate. The best second income stream matches your existing skills or something you’re eager to learn.

Research the Market

Look for gaps, trending niches, or areas where your skills are in demand. Whether you’re considering online tutoring or launching a blog, understanding the landscape is crucial. For example, this Side Hustle Blogging Guide offers actionable steps for starting a profitable blog as a second income stream.

Choose Your Side Hustle

Pick one opportunity to focus on. Avoid spreading yourself too thin at the start.

Juggling a second income with a full-time job takes planning. Use scheduling apps, automation tools, and time blocks to protect your personal time. Connect with online communities and mentorship groups for support and accountability.

Measure your progress regularly. Celebrate small wins, learn from setbacks, and be willing to tweak your approach. Remember, many people find that a second income not only boosts their finances but also enhances their work-life balance. In fact, the Quicken Survey on Side Hustles highlights how extra income streams can lead to both higher earnings and more freedom.

Start small, stay consistent, and let your second income evolve as you gain experience. Your journey begins today.

If you’re feeling inspired to start building your second income with AI tools and creative side hustles, you’re not alone—so many people are jumping in and seeing the benefits firsthand. You don’t have to figure it all out on your own, either. Whether you’re curious about automating your blog, launching an AI-powered business, or just want to explore what’s possible, there’s something big on the horizon. Keep an eye out for the AI Side Hustle Toolkit drop coming soon—it’s packed with resources to help you take action and turn your ideas into real earnings.